- Crypto Briefing

- Posts

- Canton Network Builds Momentum Amidst $540 Million Treasury Vehicle

Canton Network Builds Momentum Amidst $540 Million Treasury Vehicle

On Monday, U.S.-listed biotech company Tharimmune announced a $540 million fundraise to establish a digital asset treasury (DAT) centered on Canton Coin, the yet-to-be-listed native token of the Canton Network. Participants of the deal include major firms such as DRW Holdings, ARK Invest, Tradeweb, and Kraken.

This Robinhood earnings presentation chart was a bit of a flex. The U.S. fintech now boasts eleven business lines that each generate >$100 million in annualized revenue.

Yes. Eleven. Two of these are crypto-related: retail trading on Robinhood and institutional volumes from Bitstamp, the crypto exchange it acquired last year. Together, they chipped in $268 million to last quarter’s $1.27 billion in net revenue (21%).

But it was a third product that stole the show on the earnings call: prediction markets. CEO Tenev called it the fastest-growing product in company history, already earning a seat at the nine-figures-revenue-table.

Apparently, Google likes them, too. Just yesterday, it integrated both Polymarket and Kalshi into Google Finance. What were the odds?

Today, we’ll also talk about:

Canton Network builds momentum amidst $540 million DAT

Stream Finance loses $93 million, triggering a debate around DeFi lending

Swiss BX Digital partners with Ondo for tokenized equity

HIGH SIGNAL NEWS

Balancer suffers $128 million exploit across multiple chains. The DeFi protocol lost funds in what security firm BlockSec called a “highly sophisticated invariant manipulation attack.” Efforts to contain and recover funds are ongoing.☣️

Monad sets mainnet and token launch for November 24. The next-generation, EVM-compatible Layer-1 will debut alongside the MON token airdrop to over 225,000 eligible users.📅

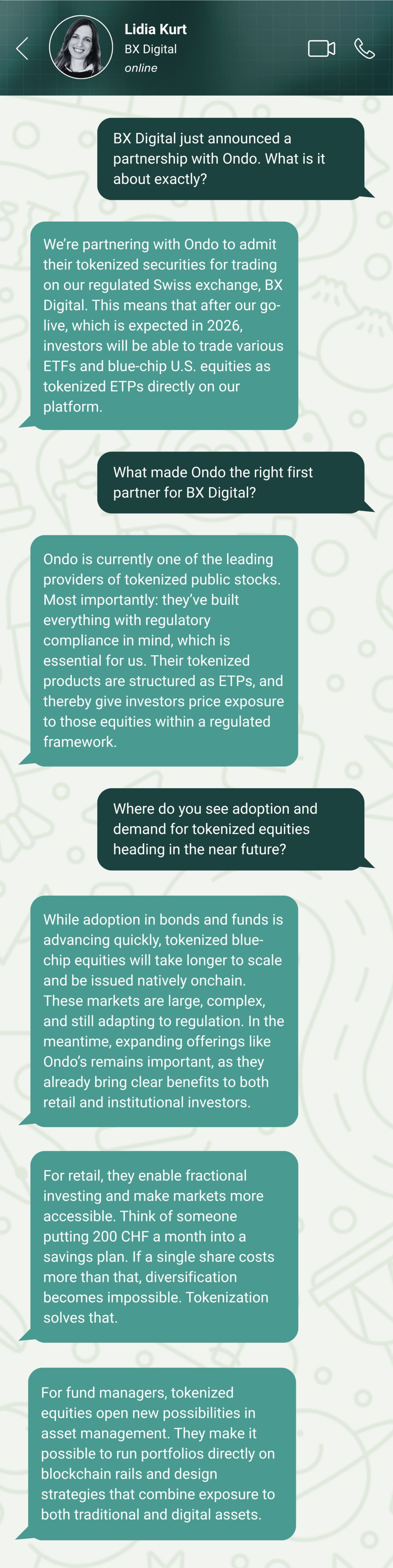

BX Digital partners with Ondo Finance on tokenized stocks and ETFs. The Boerse Stuttgart–backed exchange will list Ondo’s tokenized stocks and ETFs as Swiss ETPs, offering real-time settlement and global transferability. For more insights into the partnership, see our conversation with BX Digital CEO Lidia Kurt down below.🏛️

Seven blockchain leaders form Blockchain Payments Consortium (BPC). Fireblocks, Polygon, Monad, Solana, Stellar, TON, and Mysten Labs have launched BPC to unify standards for onchain payments and cross-border compliance, aiming to solve fragmentation across networks.🤝

INSTITUTIONAL ADOPTION

Canton Network Builds Momentum Amidst $540 Million Tharimmune Treasury Vehicle

Canton DAT: On Monday, U.S.-listed biotech company Tharimmune announced a $540 million fundraise to establish a digital asset treasury (DAT) centered on Canton Coin, the yet-to-be-listed native token of the Canton Network. Participants of the deal include major firms such as DRW Holdings, ARK Invest, Tradeweb, and Kraken.

Why it matters: Tharimmune will mark the first dedicated digital asset treasury vehicle for Canton Coin, giving public investors indirect exposure to the utility token powering one of the most institutionally adopted blockchains. The move follows Digital Asset’s $135 million raise earlier this year, backed by Goldman Sachs, DTCC, BNP Paribas, and Citadel Securities, as the company expands its footprint across capital markets.

Blockchain pioneer: Founded in 2014 by capital markets veterans from Citadel and DRW, Digital Asset initially focused on building smart-contract infrastructure for financial institutions. The key realization at the time was that institutions needed strong privacy while still being able to interoperate openly with other market participants — something existing blockchain infrastructure couldn’t provide.

“The biggest gap we saw was that public blockchains exposed too much, and private ones connected too little,” said Don Wilson, founder of DRW and co-founder of Digital Asset. “If we wanted real markets to move onchain, we needed a system where institutions could transact privately but still operate within a shared, open network.”

“Network of networks”: To address these limitations, Digital Asset developed Canton, a privacy-preserving blockchain that lets financial institutions operate their own ledgers with custom rules while remaining interoperable with others. Its coordination layer — known as the Global Synchronizer — ensures that all those independent networks stay in sync, allowing transactions to settle atomically across systems without exposing sensitive data.

Embedded into finance: In practice, Canton links directly with the systems financial institutions already use — custodians, clearing houses, and broker-dealers — bringing blockchain interoperability into existing market infrastructure.

“Canton integrates directly with participants like DTCC, prime brokers, custodians, rather than trying to bypass them. That’s why institutions are comfortable using it; it fits into their existing workflows instead of asking them to rebuild everything,” said co-founder and CEO Yuval Rooz.

Growing traction: That compatibility is paying off. According to company data, Canton now counts over 575 validators and supports 20 to 30 active applications spanning treasuries, repo, private credit, and insurance. Recent proof-of-concepts include the first onchain U.S. Treasury repo executed between Tradeweb and DTCC, settled in USDC.

Converging with DeFi: People close to the company say Digital Asset is now entering its next growth phase, focused on scaling the network’s ecosystem, expanding custody integrations, onboarding additional institutional applications, and fostering a developer base that bridges its institutional core with DeFi-native markets. The new Tharimmune DAT could become a crucial voice in sharing this story with the capital markets.

John Mulreany is Senior Protocol Specialist at Kiln. The firm is a "super validator" on the Canton Network and currently supports over 40 institutions, providing them with operational reliability and infrastructure uptime.

Canton’s momentum has shifted from steady to exponential. We’ve been collaborating for about a year and launched our white-label validator service in April, but over the past six months network activity has been steadily increasing.

Both transaction volumes and interactions with apps are going up exponentially. The pace of new app deployments is also unlike anything I’ve seen on other networks. Developers are even starting to migrate from EVM and SVM ecosystems because they see where institutional adoption is actually happening.

As this growth continues, I expect Canton over the next six to nine months to attract more participants and liquidity from traditional markets onto blockchain rails, bringing net new capital onchain rather than competing for what already exists on other networks.

DECENTRALIZED FINANCE

Stream Finance Loses $93 Million, Triggers Shockwaves Across DeFi Lending Platforms

Major loss: Just one day after Balancer lost $128 million in a hack, yield-focused DeFi protocol Stream Finance disclosed a $93 million loss tied to one of its external fund managers. In response, the platform suspended all deposits and withdrawals, freezing roughly $90 million in remaining user funds as of now.

Why it matters: Over the past year and a half, a new wave of modular DeFi platforms like Morpho and Euler turned lending into an open marketplace, where anyone can launch a custom vault, set their own risk rules, and attract deposits. That freedom fueled explosive growth, with total value locked jumping from about $3 billion to over $13.6 billion. Stream Finance’s crash represents the first stress-test for this “vault curator model”.

The trigger: Stream Finance promised depositors up to 18% yield on USDC. To reach that high return, an external fund manager supposedly took the money offchain and used heavy leverage on a delta-neutral strategy. In that case, a sudden market drop potentially wiped out one side before the other could adjust, burning $93 million.

Not-so-stable-coin: That damage landed hardest on xUSD, the yield-bearing stablecoin Stream issued as a deposit receipt. Within hours of the news, panic selling drove it from its $1 peg to around $0.17, where it still trades today.

Bad debt: For lending vaults accepting xUSD as collateral, this became a major problem. Many of them used fixed prices for xUSD — a common setup for tokens representing shares of onchain funds — so the drop in value wasn’t reflected in the system. That meant the collateral looked more valuable than it really was, blocking liquidations and causing losses for lenders. According to estimates by DeFi research group YAM, roughly $285 million in assets are affected.

Bank run: Even vaults untouched by Stream felt the pressure. Fears of wider contagion sparked withdrawals, draining liquidity and pushing borrow rates past 40% in some cases to encourage borrowers to repay loans so that exiting lenders could be paid back.

Who’s to blame? Most point to Stream’s lax risk controls, yet debate swirls around the modular infrastructure itself, especially the permissionless curator system powering Morpho and Euler:

“Lending only works when people believe the markets are sound […]. Once that trust breaks, you get the onchain version of a bank run. That’s why a model where anyone can spin up a vault permissionlessly and market it on the same platform has built-in weaknesses. Since most strategies are already commoditized, curators don’t have many ways to stand out. They either lower fees to the bone or take on more and more risk to attract capital from other pools,” wrote Stani Kulechov, founder & CEO of leading lending platform Aave.

The other side: Defenders highlight modularity’s strengths, noting that risk varies by design, just like in traditional finance, where some funds perform well while others don’t. Paul Frambot, co-founder and CEO of Morpho, countered:

"The fact that only 1 out of ~320 vaults on the Morpho App had limited exposure to xUSD isn't evidence that the model doesn't work — quite the opposite. Morpho's isolated market + vault model meant all 319+ other vaults and their depositors, each with different risk profiles, had zero exposure."

Sébastien Dérivaux is the co-founder of Steakhouse Financial, a leading DeFi curator with over $1.5 billion under management and partnerships with traditional players such as Janus Henderson, Apollo, and SG-Forge.

The current debate around modular lending misses the point. Stream Finance did not fail because of infrastructure; it failed because of investor behavior, opacity, and weak risk controls.

The users who lost money were not retail savers. They were crypto-native investors chasing yield in risky vaults. xUSD disclosed little about allocation or the source of returns. That should have been disqualifying. We ran diligence, saw the opacity, and did not interact. Many investors and several curators skipped that step.

This is a maturity problem in the curator layer. Curators sit between neutral infrastructure and capital, yet few run professional playbooks. What the space needs now is professionalization: clear transparency on where funds go, faster automation and monitoring to detect liquidity stress and hidden exposure, and real accountability, for example by curators putting their own capital at stake to show skin in the game, as is standard in traditional hedge funds.

Fomo | $17 million | Series A : Cross-chain crypto trading app.

Arx Research | $6.1 million | Seed: Developer of “Burner Terminal”, a handheld crypto point-of-sale device that lets merchants accept tap-to-pay stablecoin payments directly, thus bypassing banks, card networks, and chargebacks.

Harmonic | $6.1 million | Seed: Solana infrastructure startup that allows Solana validators to source blocks from multiple competing builders in real time, in order to unlock greater speed for the blockchain.

Sprinter | $5.2 million | Seed : Platform that makes moving crypto across different blockchains faster and cheaper by automatically finding the best transaction routes and protecting users from hidden fees.

A conversation with Lidia Kurt, CEO of Swiss-based BX Digital, about the firm’s partnership with Ondo to enable the admission and trading of tokenized stocks.

What do you think of today's briefing? |

Disclaimer: The information provided in the Crypto Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.

Reply