- Crypto Briefing

- Posts

- Galaxy Launches "GalaxyOne," Marking Strategic Expansion Into Retail Market

Galaxy Launches "GalaxyOne," Marking Strategic Expansion Into Retail Market

On Monday, digital asset company Galaxy Digital launched “GalaxyOne,” giving U.S. investors access to crypto, traditional stock trading, and high-yield cash accounts through a single integrated platform.

Square is taking another swing at bitcoin payments. On Wednesday, the payments provider announced that its four million merchants will soon be able to accept BTC — with zero processing fees.

Just between us, we’re a bit skeptical. Even most hardcore bitcoiners would agree these days that you’d rather save than spend your coins, which is why Square’s second announcement makes more sense: merchants will also soon be able to automatically convert a portion of each sale into bitcoin for long-term treasury savings.

That news dropped in the same week that Meanwhile, a provider of so-called “bitcoin-denominated life insurance,” raised $82 million in funding. We chatted with their founder to dig into this emerging category of bitcoin-native savings. You’ll find the conversation below.

Today, we’ll also talk about:

Galaxy expands into retail with GalaxyOne

Ethena secures Jupiter in stablecoin-as-a-service race

HIGH SIGNAL NEWS

Luxembourg proposes bitcoin allocation. The country's Intergenerational Sovereign Wealth Fund (FSIL) wants to allocate 1% of its portfolio, or about $7 million, to bitcoin through ETFs, the finance minister announced on Thursday. The move would make Luxembourg the first Eurozone country to introduce sovereign exposure to digital assets.🇱🇺

Vitalik doubles down on privacy. Together with the Ethereum Foundation, the Ethereum founder introduced Kohaku, a set of primitives that enables wallets to be secure and to process private transactions while minimizing dependencies on trusted third parties.🥷

S&P Global launches crypto index. The S&P Digital Markets 50 Index tracks 35 digital asset companies and 15 cryptocurrencies. Dinari, a leading provider of tokenized U.S. public securities, will also create and launch a token that tracks the benchmark.💸

Citi backs stablecoin platform BVNK. The company, which is already backed by Visa, powers stablecoin services for clients like Worldpay, Flywire, and dLocal, and claims to process over $20 billion annually.💰️

First U.S. issuers add staking to spot crypto ETFs. While 21Shares added staking to its ETH ETF, Grayscale did so with its ETH ETF and SOL Trust.🇺🇸

CRYPTO FINANCIAL SERVICES

Galaxy Launches "GalaxyOne," Marking Strategic Expansion Into Retail Market

Expansion: On Monday, digital asset company Galaxy Digital launched “GalaxyOne,” giving U.S. investors access to crypto, traditional stock trading, and high-yield cash accounts through a single integrated platform. For Galaxy, whose crypto business has so far centered on serving institutional clients across trading, lending, and asset management, the launch represents its first offering designed for retail investors.

Why it matters: Galaxy isn’t the first to expand into crypto-native fintech products and attempt to build what’s essentially a financial “super-app.” In recent months, players like EtherFi have been aggressively pushing into this segment. And in the past few weeks alone, other teams such as the Tether-backed Layer 1 Plasma, the Layer 2 network Mantle, and stablecoin issuer Ethena Labs have also announced their own offerings.

A new distribution channel: Galaxy’s approach builds on a key strength: its institutional foundation.

“At its core, GalaxyOne is a new distribution channel for Galaxy Digital, whether it's staking infrastructure, asset management products, or trading functionality. The things that Galaxy has been known for and has developed for its institutional business, we’re now looking to package and deliver through the app to individual investors,” says Zac Prince, Managing Director at Galaxy and Head of GalaxyOne.

Core features: Specifically, the new platform introduces the following key offerings:

Cash: High-yield cash account offering 4% APY on deposits, insured by the FDIC.

Crypto: Buying, trading, and holding of digital assets, starting with BTC, ETH, SOL, and Pax Gold (PAXG) by Paxos.

Brokerage: Commission-free trading of over 2,000 U.S. stocks and ETFs.

Who’s it for: Prince is clear about GalaxyOne’s target market: “I think some people will say we’re trying to compete with Robinhood or Coinbase, and there are elements of that. But we’re focused on a different audience: the mass affluent consumer.”

Galaxy Premium Yield: To serve this segment, Galaxy is introducing Galaxy Premium Yield, an investment product for accredited U.S. investors that requires a minimum investment of $25,000 and offers returns of up to 8% APY.

Experienced leadership: The yield for the Premium Yield account is generated by Galaxy’s institutional lending business — a model that Prince is intimately familiar with. Before joining Galaxy, he founded and led BlockFi, a crypto lender that managed nearly $14.7 billion in client assets and served about 400,000 U.S. investors at the height of the last market cycle.

Contentious track record: In early 2022, however, BlockFi came under SEC scrutiny for failing to register its lending products and for making misleading statements about portfolio risks. It later settled with regulators, suspended its U.S. interest accounts, and filed for bankruptcy after the collapses of Three Arrows Capital and FTX.

Lesson learned: “I learned a ton from BlockFi,” Prince said in an interview. “My personal risk appetite and professional risk appetite is wildly different, much more conservative now, obviously based on the experiences that we had.”

What’s next: Over the coming months, GalaxyOne plans to expand its offerings with new account types such as business accounts, crypto staking, and access to crypto-backed loans, allowing investors to borrow against their holdings directly on the platform.

Benjamin Harvey is a researcher at Keyrock, a global crypto investment firm offering solutions in market making, OTC trading, and options.

GalaxyOne is best understood as a retail distribution layer for Galaxy’s institutional crypto infrastructure. By bundling yield, crypto, and equities into a single platform, Galaxy positions itself to capture capital and direct it into its higher-margin businesses like lending, trading, and staking.

The strategy isn’t far from Michael Saylor’s playbook: pull in cash from traditional finance and channel it toward crypto markets, which, in this case, happen to touch Galaxy’s own books. Having an established institutional lending business here is a real differentiator from apps that merely pass through Treasury yields.

At a macro level, the rise of platforms pursuing such strategies could have a second-order effect on the crypto lending and DeFi space as a whole: as distribution broadens and capital becomes less scarce, overall rates are likely to gradually compress. That would ultimately be a good thing, signalling a new stage of maturity in crypto markets.

STABLECOINS

Ethena Expands Whitelabel Offering, Accelerates Rise of Ecosystem Stablecoins

Major partnership: On Wednesday, Solana’s leading DeFi protocol Jupiter announced that it will launch its own stablecoin, JupUSD, by the end of 2025. The new asset will leverage the whitelabel solution from stablecoin issuer Ethena Labs and be deeply integrated into Jupiter’s entire product suite, including perpetual futures, spot trading, lending, and a range of yet-to-be-announced products.

Why it matters: The move highlights a broader shift in stablecoin market dynamics. Rather than leaving reserve yields to issuers like Tether and Circle, protocols and wallet providers are increasingly launching their own stablecoins to capture that income directly. The recent bidding war over Hyperliquid’s native stablecoin was just another clear illustration of this.

The opportunity: For Jupiter, the upside is substantial. Its JLP vault, where users deposit assets to earn a share of perpetuals-trading fees, currently holds about $800 million in USDC. If that capital migrates to JupUSD — a shift the team has already confirmed — Jupiter could generate $32 million in additional annual revenues, assuming a 4% Fed funds rate.

Plug-and-play: To seize similar opportunities, many protocols today are turning to whitelabel solutions from providers like Ethena, M0, and, more recently, fintech giant Stripe, rather than building their own stablecoin infrastructure from scratch.

Partnership spree: Ethena in particular has been on a deal-making spree. Beyond JupUSD, its whitelabel platform will also power the USDm stablecoin for MegaETH, one of the most anticipated new Layer 2 networks, and two forthcoming stablecoins on the Sui Layer 1.

How it works: Ethena’s solution lets partners back their coins with the issuer’s two existing stablecoins: USDe, backed by Ethena’s high-yielding delta-neutral trading strategy, and USDtb, backed by BlackRock’s tokenized money market fund BUIDL. This gives them direct access to the $16 billion liquidity of crypto’s third-largest stablecoin issuer, allowing their own stablecoins to scale from day one. They can also fine-tune the risk-return profile by adjusting the collateral mix between USDe and USDtb.

Outlook: According to Ethena co-founder Guy Young, this wave of partnerships is only the start. “By October,” he said, “more than 50% of every major chain, application, and wallet with critical mass and existing user distribution will launch their own whitelabel stablecoin.”

Dan Elitzer is the co-founder of Nascent, an early-stage venture firm that has invested in over 50 teams since 2020, including projects like Flashbots, Morpho, and Ethena.

White-label stablecoins are the hot trend, but honestly, they were always inevitable. The Circle/Coinbase revenue split set the precedent: whoever owns the user relationship wants to own the economics, and they’re going to mostly have to pass that along to their users to stay competitive. If you’re a chain or an app with a sticky user base, why would you leave that on the table?

As this model gets commoditized, the real differentiation won’t be in who can quickly help others slap their logo on a stablecoin; it’ll be in who can actually deliver scale, safety, and likely the option for differentiation with yield beyond just treasuries. That takes us into synthetic dollar territory, and Ethena is the only one who can do it. Billions minted, billions redeemed, and now more than $16 billion in deposits less than two years in.

Meanwhile | $82 million | Series B : Provider of BTC-denominated life insurance, annuities and savings products (see our Proof-of-Talk for more insights)

Hivemapper | $32 million | Unknown : Decentralized mapping network.

Coinflow | $25 million | Series A : Stablecoin payments provider for businesses.

Block Street | $11.5 million | Seed : An execution & lending layer for tokenized equities.

375ai | $10 million | Multiple rounds : Developer of a decentralized edge data intelligence network to capture data in the physical world.

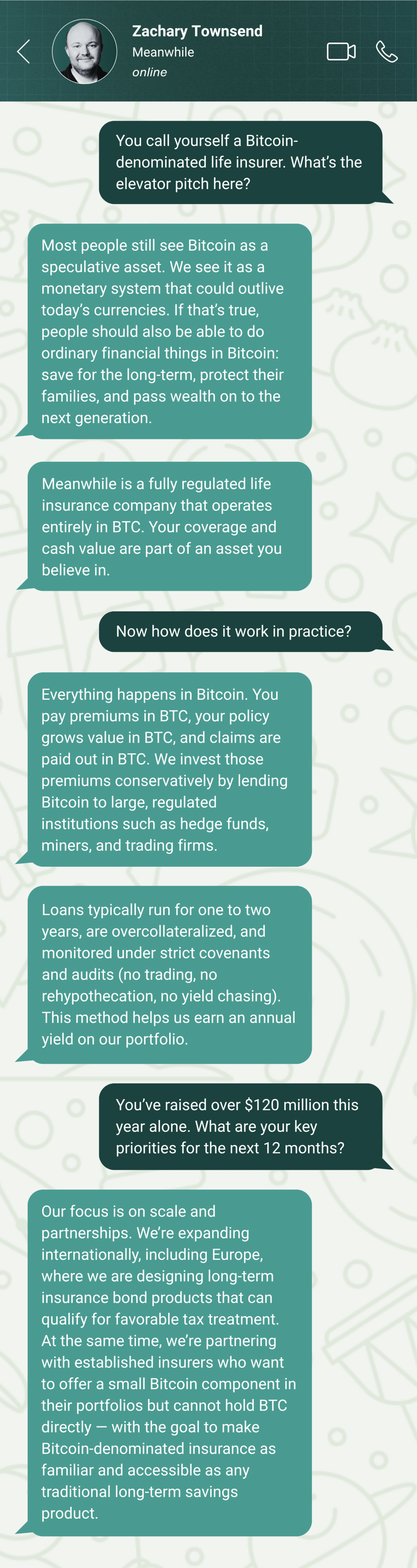

A conversation with Zachary Townsend, co-founder and CEO at Meanwhile, a Bitcoin-denominated life insurer, who announced an $82 million fundraise on Tuesday.

What do you think of today's briefing? |

Disclaimer: The information provided in the Crypto Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.

Reply