- Crypto Briefing

- Posts

- Lido Launches v3, Aiming to Bring Liquid Staking to Institutions

Lido Launches v3, Aiming to Bring Liquid Staking to Institutions

Last Friday, crypto’s leading liquid staking protocol, Lido, went live with its newest version on Ethereum. Dubbed Lido v3, the upgrade is designed to give institutions such as asset managers greater control over their ETH staking setups.

It’s a bloodbath outside. Bitcoin has now wiped out all gains since Trump’s election. Vitalik is distancing himself from the original L2 vision. Kyle Samani is stepping back from Multicoin. And Bloomberg delivered ten reasons why this is the worst crypto winter ever.

Meanwhile, Philip Morris is approaching new all-time-highs, and it makes perfect sense.

The gap between price action and institutional momentum has never been wider. So we're zooming out. On February 19, we’re hosting a webinar on three of the most interesting trends: onchain vaults, fund tokenization, and innovations in crypto-ETPs. Join us and let’s get excited again.

Today, we take you behind the scenes of:

Lido launches v3, aiming to bring liquid staking to institutions

Why onchain options are a category to watch

HIGH SIGNAL NEWS

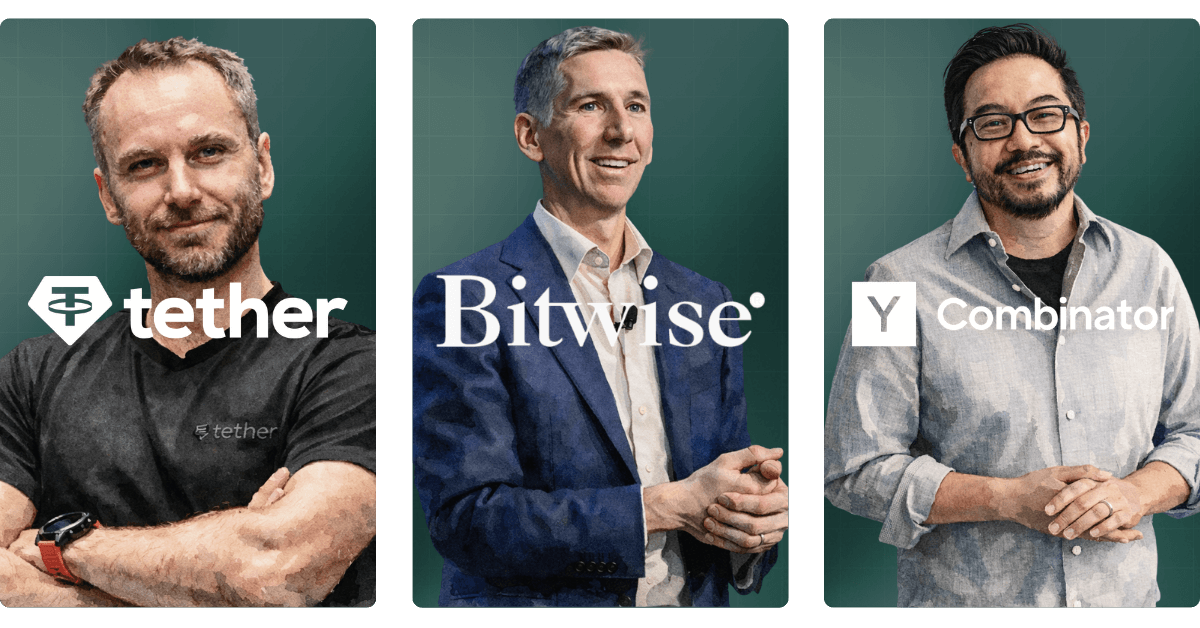

Tether announces major investments. Yesterday, the firm announced a $100 million investment in Anchorage Digital, the stablecoin infrastructure provider that also powers Tether’s newly launched USAT stablecoin. A few hours later, news broke that Tether had acquired a $150 million stake in Gold(.)com, aiming to expand distribution of its gold-backed XAUT token. 💰️

Bitwise acquires staking provider Chorus One. With this acquisition, the leading crypto asset manager gains institutional-grade staking capabilities securing ≈ $2.2 billion in staked assets. Both firms did not disclose financial details. 🤝

Y Combinator adds stablecoin-based funding. From now on, startups that are funded by the prominent incubator can choose to receive their $500,000 funding in stablecoins. 💸

Hyperliquid announces HIP-4, intends to launch outcome trading. After a testing phase on testnet, the leading decentralized trading platform is set to support both options and prediction markets. 🔮

Kraken publishes 2025 Financial Highlights, introduces new company structure. Last year, the leading crypto platform generated $2.2 billion in revenue, representing 33% year-over-year growth. In parallel, it introduced Payward, a new parent company consolidating Kraken and its acquired businesses, such as xStocks and NinjaTrader. 🐙

ONCHAIN ASSET MANAGEMENT

Lido Launches v3, Aiming to Bring Liquid Staking to Institutions

Upgrade: Last Friday, crypto’s leading liquid staking protocol, Lido, went live with its newest version on Ethereum. Dubbed Lido v3, the upgrade is designed to give institutions such as asset managers greater control over their ETH staking setups. At the same time, it preserves access to on-demand liquidity through liquid staking, a combination intended to lower barriers to entry and drive broader institutional adoption of ETH staking.

First mover and market leader: By introducing liquid staking on Ethereum in 2020, Lido materially improved capital efficiency for staked ETH. Today, around 23% of all staked ETH (≈ 8.5 million ETH, representing roughly 7% of total supply) is staked through Lido, cementing its position as the market leader and making stETH the most liquid liquid staking token.

Why it matters: Lido’s battle-tested infrastructure and deep stETH liquidity are already key reasons it is used by major asset managers, including WisdomTree, for fully staked ETH ETPs. However, more conservative and less crypto-native institutions often require greater control over staking operations than the core Lido protocol provides. Lido v3 addresses this gap by offering a more flexible and customizable staking framework designed to meet institutional requirements.

"A major piece of feedback we've received from institutions is the desire for greater customization, including the ability to choose between node operators, select the custodian, and decide if and when to mint stETH. With Lido v3, we are delivering exactly that," Kean Gilbert, Head of Institutional Relations at Lido, told us.

How it works: With Lido v3, institutions are no longer limited to Lido’s standard pooled configuration. Instead, they can deploy dedicated staking vaults with clearly defined parameters, such as node operator selection, fee structure, and risk controls, while continuing to stake ETH through Lido’s existing infrastructure and network of more than 800 node operators.

The best of both worlds? Crucially, stETH is no longer mandatory. Institutions can stake ETH natively by default and only mint stETH against the staked position if and when liquidity is required. This sets Lido v3 apart from traditional staking providers by combining institutional-grade customization with access to near-instant liquidity, bringing flexibility and capital efficiency together in a single framework.

Fully staked ETPs: According to Gilbert, this is particularly relevant for ETP issuers looking to launch fully staked ETH products, without relying on a liquid staking token as the underlying asset.

“From our conversations with issuers, many want to offer investors exposure to natively staked ETH rather than a liquid staking token, as it does not require additional education. With v3’s vault structure, this becomes possible, allowing issuers to launch a natively staked ETF while still accessing liquidity by minting and selling stETH as needed to meet redemptions.”

Beyond ETP issuers: While fully staked ETPs are a key application, the same vault architecture also enables yield-focused strategies. Crypto-native asset managers and ETH-focused DATs can use vaults to enhance staking returns, for example through looping or other DeFi-based strategies. These approaches remain optional and operationally segregated, allowing institutional and crypto-native use cases to coexist on the same infrastructure without sharing risk.

Webinar: WisdomTree will be one of the presenting partners for our upcoming webinar on February 19. Join us if you want to get a deeper insight into their partnership with Lido. Register here.

Adrian Fritz is Chief Investment Strategist at 21shares, a leading crypto ETP issuer, which oversees over $10 billion in assets.

As staked ETH ETF listings in the U.S. are expected to pick up significantly this year, Lido seems to be strategically positioning itself to serve rising institutional demand.

In this context, the changes introduced around operator selection in v3 matter for two core reasons. First, compliance. A U.S.-based entity cannot stake through validators in restricted jurisdictions.

Second, risk isolation. Under Lido’s v2 model, losses caused by any validator were shared across all stakers, forcing institutions to bear risks they neither selected nor controlled. With v3 vaults, exposure is limited to KYC’d validators an institution has explicitly chosen, enabling far more robust risk management.

Combined with the deep liquidity of stETH, these changes position Lido as the most practical choice for asset managers launching staked ETH products.

ONCHAIN OPTIONS

Derive: “Building the Onchain CME” — Interview with Co-Founder Nick Forster

Fundraise: On Monday, the prominent crypto VC Variant disclosed a direct token investment in the leading onchain options exchange Derive. The announcement follows increased attention on onchain derivatives, as so-called real-world asset perpetual futures hit record volumes last week (see last week’s Briefing).

Why it matters: Compared to perpetual futures, onchain options are still nascent. Weekly notional trading volumes on Derive average around $150 million, while perpetual futures DEXs generate more than $170 billion per week on average over the same period.

Market gap: Interestingly, this imbalance contrasts sharply with traditional finance, where options account for the majority of derivatives trading. In recent years, volumes have typically skewed toward roughly 70% options and 30% futures.

Interview: Together with Nick Forster, co-founder and CEO of Derive, we discussed how this gap emerged, why onchain options are gaining traction now, and why he expects 2026 to mark the entry of institutions into onchain options.

__________________

Why have onchain options struggled to gain adoption?

“Historically, options have been the last instrument to mature in any market. They require deep spot liquidity, a meaningful base of institutional participants, and developed futures markets for hedging. This build-out just takes time, and I believe for crypto, those prerequisites are only now beginning to fall into place.

Additionally, there simply wasn’t much demand for options in most of DeFi’s history. Yield was abundant and relatively easy to access, which made more complex instruments unnecessary. From 2021 through early 2025, strategies like the basis trade generated consistent returns, and platforms such as Pendle allowed users to turn token incentives into fixed-income-like products. At their peak, these strategies offered 20-30% annual returns with limited perceived risk.”

Why are onchain options gaining traction now?

“The earlier described yield environment has now changed. Arbitrage yields compressed as institutional capital entered the market, and token-based incentives lost much of their appeal as new launches underperformed. With “easy yield” largely gone, capital is increasingly looking for strategies where risk and payoff are clearly defined.

This is where options come in. Options allow traders to structure risk precisely, express specific views, and build strategies that don’t rely on ongoing yield subsidies. As markets mature, demand naturally moves toward instruments with transparent outcomes.

At the same time, onchain infrastructure has caught up. One of the largest neobanks is now building a structured product on top of Derive: a vault that algorithmically runs option-based strategies. The team initially tried to build this on Deribit, the largest centralized options venue, but ran into limitations tied to offchain infrastructure. Those constraints don’t exist onchain, which is why we’re seeing real adoption emerge now rather than earlier.”

What drives institutional adoption of onchain options in 2026?

“The catalyst is Hyperliquid. The opportunity was large enough that institutional firms invested heavily in building the workflows needed to trade onchain, with most of that work completed in late 2025. Once those systems are in place, expanding into broader DeFi, and particularly options, becomes straightforward.

Options also offer what other instruments, like perpetual futures, cannot: liquidation-free leverage on long-term positions. You pay a premium upfront, and outcomes depend solely on your thesis at expiration, not interim volatility. For institutions holding significant assets onchain, this makes options the natural instrument for sophisticated strategies.

This momentum is reinforced by major unlocks on the infrastructure side, such as our recently launched off-exchange custody solution. It allows institutions to trade options onchain while keeping assets with their chosen custodian, eliminating bridging, wrapping and smart contract risk. So, it is really the combination of maturing infrastructure alongside growing liquidity and sustained demand for onchain yields that makes me optimistic about 2026.”

__________________

In addition, we discussed with Forster:

why options are more appealing to institutions than perpetuals,

Derive’s growth strategy and competitive positioning,

and the real growth opportunity for onchain options.

TRM Labs | $70 million | Series C : Blockchain analytics & intelligence firm.

Relay | $17 million | Series B : Cross-chain infrastructure provider.

What do you think of today's briefing? |

Disclaimer: The information provided in the Crypto Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.

Reply