- Crypto Briefing

- Posts

- SG-FORGE Officially Enters DeFi, Aims To Boost Stablecoin Growth

SG-FORGE Officially Enters DeFi, Aims To Boost Stablecoin Growth

On Tuesday, Société Générale, via its blockchain arm SG-FORGE, has become the first global systemically important bank (G-SIB) to integrate its euro (EURCV) and dollar (USDCV) stablecoins into leading DeFi protocols.

Bitcoin spot ETFs keep rewriting the record books. On October 1, BlackRock’s IBIT broke into the top 20 ETFs, less than two years after launch. No fund has ever crossed $90 billion in assets this fast.

The top 10 is now just $50 billion away. Small wonder, reports now suggest Vanguard is preparing to add crypto ETFs to its brokerage platform after years of resistance.

At current AUM, IBIT is already throwing off more than $200 million a year in fees. Vanguard’s hardline refusal, by contrast, has left a lot of money on the table.

Today, we’ll talk about:

SG-Forge officially enters DeFi to boost stablecoin demand

DoubleZero debuts mainnet beta and token

Bitcoin-lending startup Lava raises $17.5 million

HIGH SIGNAL NEWS

Stripe introduces stablecoin issuing platform. With "Open Issuance," businesses can more easily launch their own stablecoins, while Bridge manages reserve backing, security, liquidity, and GENIUS-ready compliance behind the scenes. Early users include Phantom, Native Markets, Metamask, and Dakota.💵

CME Group to launch 24/7 crypto futures and options trading. The offer is expected to go live in early 2026, pending regulatory approval.🕰️

Major fintech platform announces stablecoin payments. Soon, more than 20,000 customers of leading spend management platform Brex will be able to send and receive USDC payments on Solana.💸

Monthly perp DEX volumes top $1 trillion for the first time. The surge comes amid fierce competition in the sector, with upstarts like Aster and Lighter battling to take market share from leader Hyperliquid.📈

INSTITUTIONAL ADOPTION

Société Générale-FORGE Officially Enters DeFi, Aims To Boost Stablecoin Growth

Institutional debut: On Tuesday, Société Générale, via its blockchain arm SG-FORGE, became the first global systemically important bank (G-SIB) to integrate its euro (EURCV) and dollar (USDCV) stablecoins into leading DeFi protocols.

Why it matters: Until now, EURCV and USDCV have remained relatively modest in scale, with circulating supplies of roughly €56 million and $32 million, trailing competitors like Circle’s EURC, which has surpassed €220 million. By opening these stablecoins to permissionless borrowing, lending, and spot trading on platforms such as Morpho and Uniswap, SG-Forge is aiming to accelerate adoption and bring new liquidity into its tokens.

From hesitation to action: This push into DeFi marks a notable shift. As Blockstories exclusively reported in June, SG’s compliance team had long resisted such exposure, citing concerns over the lack of transparency into stablecoin holders — despite MiCA explicitly allowing issuers not to identify end-investors at all times.

Things are moving forward in a step-by-step progression to bring an entire banking group in this direction,” Jean-Marc Stenger, CEO of SG-Forge, explained to us.

Following demand: According to Stenger, this progression has been driven by rising client demand, especially for an EUR stablecoin: “Crypto has gone mainstream and we’re receiving requests from all client segments, from retail to institutional. Many partners are interested in offering euro-denominated earn solutions. Beyond that, Europe needs its own euro stablecoins, issued by European players, capable of holding their ground against other markets.”

New endeavour: To meet this demand, SG-Forge is now embedding its stablecoins into the DeFi ecosystem with support from French crypto firms and infrastructure partners.

Lending: On Morpho, users can now borrow in EURCV and USDCV, with collateral options including ETH, BTC, and tokenized money-market funds from French startup Spiko. Risk firm MEV Capital will manage these vaults.

Trading venues: SG-Forge has also launched Uniswap liquidity pools for both stablecoins. Managed by market maker Flowdesk, they enable permissionless spot trading of EURCV and USDCV.

More DeFi integrations: These initial steps are just the beginning. “We expect numerous integrations in the coming months, including with the largest and most well-known platforms in the DeFi market. We are already in advanced discussions with all of them,” Stenger said.

Next steps: “Our three current priorities are clear: increasing liquidity, expanding distribution, and developing payment services around our stablecoins.”

Sébastien Dérivaux is the co-founder of Steakhouse Financial, a leading DeFi curator with over $1.5 billion under management and partnerships with traditional players such as Janus Henderson, Apollo, and SG-Forge.

Having a Tier 1 bank integrate its stablecoins into Uniswap and Morpho is a watershed moment for DeFi. Euro stablecoins have struggled to gain traction globally, and SG-Forge is trying to change that by using incentives to drive activity. For now, however, those incentives remain modest, around €2,000 of EURCV distributed daily, compared to roughly $130,000 for Ripple’s rlUSD and $70,000 for PayPal’s PYUSD. Can a European player really compete with this?

Incentives, though, are only the beginning. Sustained adoption comes from embedding stablecoins into fast-growing DeFi-native issuers like Ethena in recent months. Consider also why stablecoin issuers were rolling out the red carpet to secure HyperEVM’s USDH.

Another path is CeDeFi, with Coinbase showing how quickly liquidity can scale after its users supplied $100 million USDC to Morpho in just two weeks. For SG-Forge, partnerships with platforms like Bitpanda could be next.

INFRASTRUCTURE

DoubleZero Debuts Mainnet Beta and Token — Interview with Co-Founder Austin Federa

Double launch: Yesterday, the DoubleZero network had two reasons to celebrate. First, it rolled out the long-awaited mainnet beta, a major step toward its goal of becoming the blockchain-native alternative to the public internet. At the same time, its native $2Z token went live, debuting at a fully diluted valuation (FDV) of about $6 billion.

Why it matters: “To make blockchains as performant as traditional, centralized systems and to truly bring all of finance onchain, we need to go beyond improvements at the software level,” Austin Federa, former Head of Strategy at the Solana Foundation and one of the co-founders of DoubleZero, told us. “That's why we set out to build a parallel internet for high-performance blockchains.”

Big plans: For this purpose, the team raised $28 million from top-tier VCs such as Multicoin Capital, whose managing partner Tushar Jain calls DoubleZero "one of the most ambitious projects we've ever invested in."

Interview: In our conversation, Federa elaborated further on these ambitions, shared who’s already contributing to the network, and laid out what concrete performance unlocks DoubleZero can bring to high-performance networks like Solana.

__________________

On why DoubleZero was created:

“In recent years, networks like Solana, Aptos, and Sui have pushed scalability to new limits, processing tens of thousands of transactions per second. But to go further, software upgrades are no longer enough. The bottleneck is now the public internet, where blockchains compete with general traffic for bandwidth.

DoubleZero addresses this by building a dedicated network for blockchains that avoids congestion, increases bandwidth, and reduces latency by up to 70%, enabling performance on par with traditional exchanges like NYSE and Nasdaq.”

On how the system works:

“Our model follows the logic of a Decentralized Physical Infrastructure Network (DePIN). Independent parties with excess fiber capacity — from trading firms to infrastructure providers — contribute it to the DoubleZero network and are rewarded with tokens. Unlike proof-of-stake, rewards are proportional to each link’s performance contribution, not to capital locked.

That distinction matters because operating fiber is OPEX-heavy, with a single transcontinental line costing hundreds of thousands of dollars per month.

For validators, joining is simple. They connect through a drop-in tunnel that works like an extra network card on their server. No changes to validator clients or protocol code are required, which makes adoption plug-and-play rather than a complex technical lift.”

On the direct impact for networks like Solana:

“There are three main areas where DoubleZero makes a difference:

1. Performance: Today the Solana network operates generally somewhere around one thousand transactions per second. To push beyond that, teams like Jump Crypto are building high-performance validator clients such as Firedancer, which already demonstrated throughput of one million TPS last year. The interesting part is that this milestone was only possible because the demo ran on an early version of DoubleZero.

2. Validator economics: A reduction in latency could enable network updates such as larger Solana blocks, which would raise throughput and boost validator revenues, since more transactions per block mean more fees. Faster connections also open new opportunities for validators to capture value through new MEV opportunities.

3. Geographic diversity: Validators located far from network hubs, for example in South America, typically suffer from higher latency, which means missed slots and lower rewards. With DoubleZero, they can now perform competitively, reducing centralization pressure around a few data centers and strengthening network resilience.”

On the current state of the network and what’s next:

“During our six-month testnet, we attracted Solana validators controlling 16% of the network’s stake, and we expect this figure to rise in the coming months. And while our focus is on Solana for now, we will soon open access to validators from other blockchain networks as well.

On the supply side, the network already brings together a diverse mix of 12 fiber contributors, including DRW Cumberland, Jump, Galaxy, and bare-metal providers like TerraSwitch and Latitude.

Looking ahead, a major unlock came with the recent no-action letter from the SEC. Taking DoubleZero as a case in point, it clarified that rewarding contributors with tokens is not considered a securities transaction. For large firms like Verizon or AT&T this is decisive, as it removes securities law risk and allows them to participate in our network without worrying about compliance.”

Flying Tulip | $200 million | Seed : Onchain platform spanning all of DeFi, including spot trading, derivatives, lending, and insurance.

xMoney | $21.5 million | Strategic : Payment platform that provides businesses with a unified platform to accept, manage, and optimize payments globally.

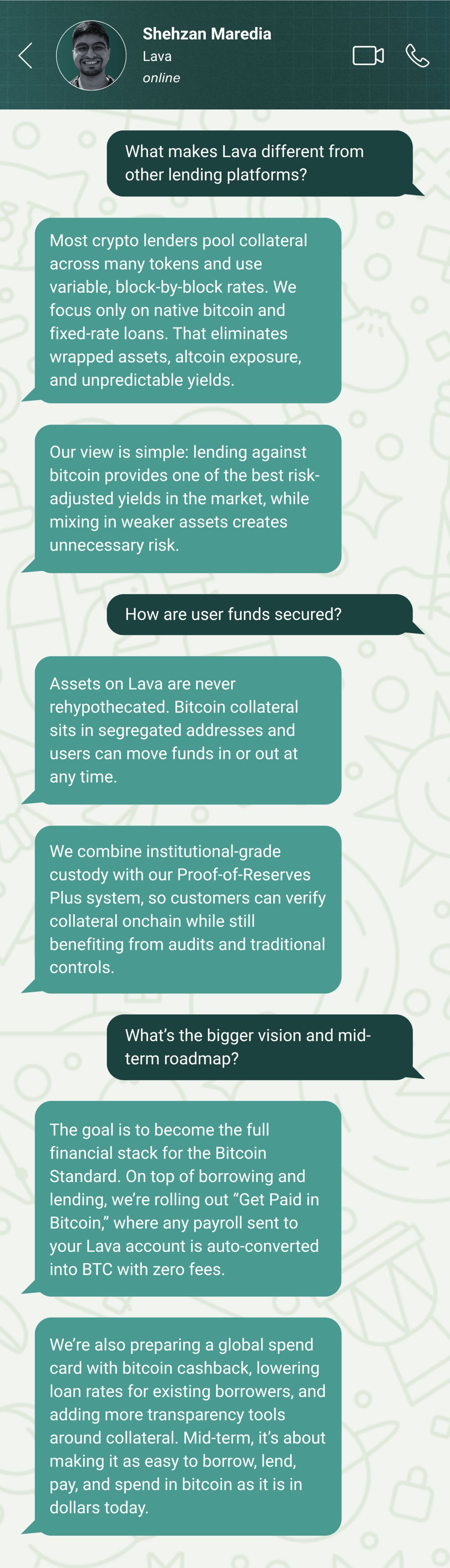

Lava | $17.5 million | Series A+ : Lending platform for bitcoin-only loans. For more insights, see our Proof-of-Talk with founder Shehzan Maredia below.👇️

A conversation with Shehzan Maredia, founder of Lava, a platform for bitcoin-backed loans that just secured $17.5 million in fresh funding.

What do you think of today's briefing? |

Disclaimer: The information provided in the Crypto Briefing by Blockstories does not constitute investment advice. Accordingly, we assume no liability for any investment decisions made based on the content presented herein.

Reply